What are ETFs?

Exchange traded funds (ETFs) are investment funds that are listed and traded on a stock exchange. An investor’s money is pooled with money from numerous investors and invested according to the ETF’s stated investment objective1. ETFs are like mutual funds, but whereas mutual fund shares can be redeemed at just one price each day – the closing net asset value (NAV)), ETFs can be bought and sold throughout the day on a stock exchange, which is the same as the case for shares. With investment in an ETF, investors gain exposure to numerous securities in a single investment transaction.

ETFs can cover U.S. and foreign markets, specific sectors, or different assets. Investment in ETFs is a form of passive investment strategy, as the ETF manager only changes the composition of the ETF when changes occur in the underlying index (e.g. S&P500, NASDAQ 100, STI) or companies the ETF manager wishes to track. As such, the ETF is aimed at producing returns that tracks a specific index such as a stock index or commodity index. Conversely, these index tracking ETFs are thereby not aimed at outperforming the index. Investors earn capital gain when the prices of the component shares rise above the initial price paid for them. Simultaneously, some ETFs also pay dividends. While most of the ETFs present in the market are passively managed, actively managed ETFs are also available. Fund managers for actively managed ETFs select stocks and perform frequent trades to outperform the underlying index so as to generate returns. They will modify the compositions within the portfolio according to their views on the market. However, actively managed ETFs are required to disclose their holdings everyday which lead to reluctance in the fund managers to create actively traded ETFs. As such, passive investing is a more popular strategy among ETF investors. In this article, we will be mainly focusing on passively managed ETFs.

Advantages of ETFs

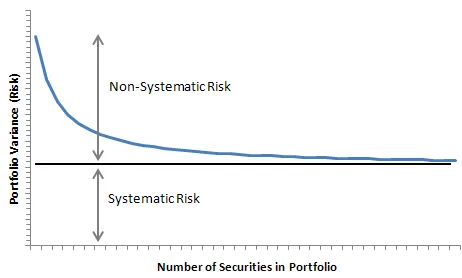

Firstly, investors can gain exposure to an index or a group of companies without having to invest in all its component stocks. This is especially crucial for investors with limited capital. Take the example of NASDAQ-100 Index ETF, Invesco QQQ. For approximately USD$3082, Investors are essentially purchasing a slice of the companies in the NASDAQ-100 Index – a stock market index made up of 103 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock market. The USD$ 308 investment is a stark contrast to the capital an investor would need if he were to purchase shares of each of the 100 companies. Therefore, ETFs allow investors to reduce their exposure to firm-specific risk and diversify their shareholdings at low-cost.

Secondly, index tracking ETFs have fees and charges that are usually lower than those of actively managed investment funds as ETFs have lower management fees. There is also usually no sales charge, although if investors trade ETFs on stock exchanges such as the Singapore Exchange, would need to pay the applicable brokerage commissions or transfer taxes depending on the brokerage.

Is investing in ETFs a 100% profitable investment?

Just like investing in a company’s shares, ETFs are not principal guaranteed. Investors may lose all or a substantial amount of their capital, depending on the performance of the ETF and therefore the shares which the ETF comprises. Often, the major risks of investing in ETFs are described in the prospectus and product sheet.

Index ETFs

Index ETFs are exchange-traded funds that seek to replicate and track a benchmark index like the Dow Jones Industrial Average, Nasdaq 100 or S&P 500 as closely as possible.

By purchasing an ETF which tracks a stock index, investors gain exposure to the performance of the index. For example, investing in an ETF that tracks the Straits Times Index (STI) provides investors with exposure to the Singapore market.

Industry ETFs

Industry ETFs are exchange-traded funds that seek to track a benchmark index for specific industry sectors by investing in the stocks and securities in the specific industry sectors. The common sectors which are present are health care, information technology, energy, financials, materials, industrials, consumer staples, consumer discretionary, telecommunication services, utilities and real estate. By investing in industry sector ETFs, investors get to gain exposure to the performance of the whole industry via the industry tracking indexes. Through this narrowed down focus within the overall stock market, investors should be prepared to experience greater volatility in their investments in the particular sector as compared to the overall stock market. Furthermore, among different industry sectors, investors have to be aware of the presence of different risk/reward profiles. For instance, the technology sector has the greatest tendency to exhibit high volatility whilst the utility sector is far more stable and has low volatility. A few well-known Technology Equities ETFs are Vanguard Information Technology ETF (VGT), Technology Select Sector SPDR Fund (XLK) and iShares U.S. Technology ETF (IYW). For Health & Biotech Equities ETFs, Health Care Select Sector SPDR Fund (XLV) and Vanguard Healthcare ETF (VHT) are among the US-traded ETFs in the Health & Biotech category.

Choosing ETFs

● Benchmark

As an investor, the most important thing that one should be concerned about is knowing what exactly is the ETF tracking. By knowing the benchmark, investors will have a better understanding of what they are investing in and the areas affecting the prices. Investors are advised to pick ETFs which are investing in areas that they are familiar and experienced with.

● Tracking Errors

Tracking errors are present when there is a difference between the performance of the ETF and the benchmark. It is important to be aware of the tracking errors as high tracking errors will indicate that the ETF is trailing behind the index that is being benchmarked. Investors should choose ETFs which have minimal tracking errors to mitigate large divergence between the performances and achieve close tracking of the underlying indexes.

● Fund’s Liquidity

Commonly, an ETF that is able to garner strong investor’s interest has a minimum level of assets of at least $10 million. With the ability to generate strong investor interests, the liquidity of the ETF will be greater and have a tighter spread. Therefore, a viable ETF is recommended to have at least $10 million assets.

Investors should also be clear about the volume of shares being traded daily to understand the ETF’s liquidity. The higher the volume of an ETF being traded, the higher the liquidity, therefore leading to a tighter bid-ask spread. If the ETF chosen is trading below a certain amount of shares per day, the low liquidity acts as a probable obstacle for investors to sell off their ETF easily in the future, especially for short term ETF traders. Therefore, the liquidity of the ETF is a key consideration for investors.

● Expense Ratio

Lastly, the cost of an ETF is also a crucial determining factor when picking a desired ETF. An expense ratio is an annual fee that the investors have to pay the fund manager for the administrative and operation expenses. This cost is subtracted from the investor’s invested fund amount which will hence, reduce the returns from the ETF. A high expense ratio may significantly drive down the returns from the ETF in the long run. Passively managed ETFs have an average expense ratio of 0.54%3. Therefore, investors should pay attention to the expense ratio for the ETF they are going to invest in.

Tax Considerations

For long term investors seeking to inject a huge amount of capital in ETFs, tax considerations might play a huge role in selecting an ETF to invest in. For instance, an ETF tracking the S&P500 index is the SPDR S&P500 ETF (Ticker: SPY), which is traded on the New York Stock Exchange. However, in the United States, there is a 30% withholding tax for foreign investors. This means that for every $1 dividend paid out by the fund, investors only receive $0.70. Such a difference is magnified when the investor invests a huge amount of capital in the ETF and holds the ETF for a long period of time.

One way to get around the tax consideration is to invest in Irish domiciled ETFs, which are also traded on the London stock exchange. Due to the tax treaty between the United States and Ireland, the withholding rate is only 15%. Furthermore, there is no withholding tax imposed by Ireland on Singapore residents. This means that for every $1 dividend paid out, the fund manager in Ireland receives $0.85 in dividend. And since there is no withholding tax imposed by Ireland on Singapore residents, Singapore residents receive the full $0.85

In investing in the US domiciled SPY, the net dividend yield after 30% withholding tax is:

1.62% * (1-0.3) = 1.134%.

This net 1.134 dividend yield is lower than the 1.38% dividend yield received if the investor were to invest in the Irish domiciled SPY5.L. Therefore, investors seeking to invest a huge amount of capital in the ETF for extended periods of time should take into account tax considerations because the tax savings could be substantial.

The Bottom Line

Investing in ETFs is a relatively stable investment strategy with reasonable yields. Take the example of the S&P500 – average annualized total return for the S&P 500 index over the past 90 years is 9.8 percent, which is substantially higher that what individuals earn in fixed deposits. However, investors still have to take note of the risk of capital depreciation and invest only if they are comfortable with this risk. Furthermore, since there are numerous ETF managers out there seeking to track the same index or industries, investors should do their due diligence and take caution in selecting an ETF provider in order to maximise their returns by minimising unnecessary costs.

References

1 https://www.moneysense.gov.sg/articles/2018/10/guide-to-etfs-understanding-exchange-traded-funds

2 As of 16 December 2020

3 https://www.etftrends.com/in-fund-industry-fee-war-etf-investors-win/

4 https://www.youtube.com/watch?v=gTdhVsT7CVo&ab_channel=TheFifthPerson