By Ong Xien Fong

After explaining the significant processes of palm oil production, this article will cover four other important points to consider when picking palm oil counters.

1. Correlation to Crude Palm Oil (CPO) Prices

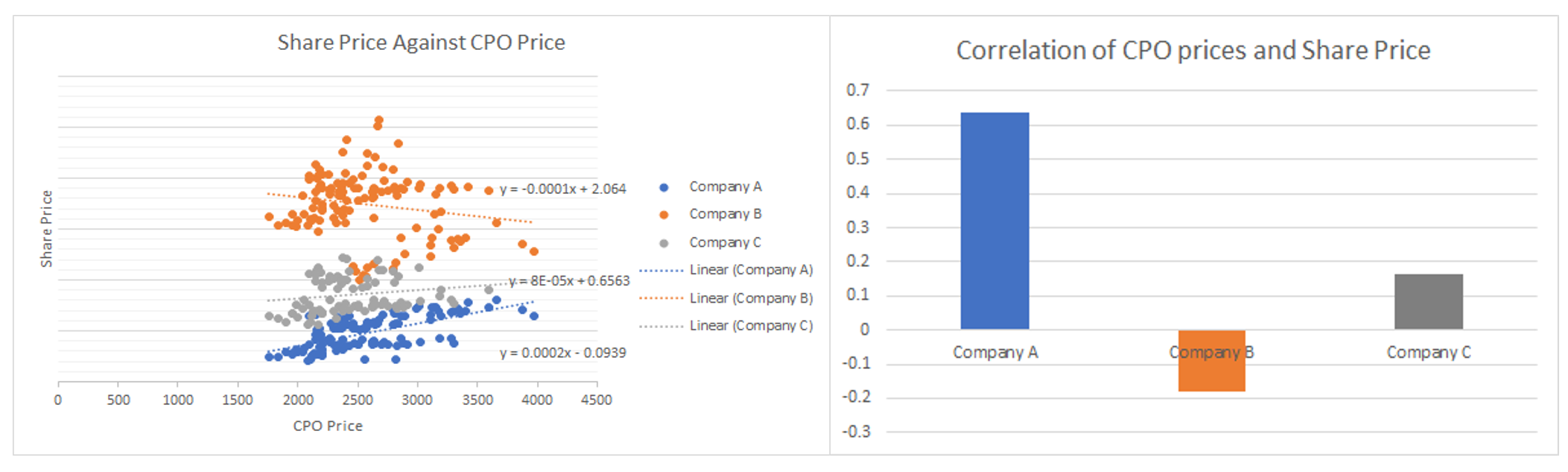

Some investors use the correlation of share price to CPO prices to determine which counters to buy. The logic from this method stems from the fact that CPO is the predominant product of palm oil producers and the increase in prices of CPO would result in an increase in the share price of the palm oil counters as well. The variation in correlation of different palm oil counters can be vast. This can be seen from the correlation bar chart (below) of 3 different SGX counters and CPO prices.

To those who are less familiar with this comparison, correlation can be calculated using Excel by using CPO prices and share prices as the two arrays of data. CPO prices can be obtained as mentioned in part I of this article while historical share prices can be downloaded from Yahoo finance. Correlation ranges from +1 to -1 with +1 being perfectly correlated, -1 being perfectly negatively correlated and 0 being uncorrelated.

Graph of Share Price against CPO Price and Linear Regression. Bar Chart of Correlation of CPO Prices and Share Price. Prices are over a 10 year horizon except for 1 company (due to the date of listing). Source: Yahoo Finance, S&P Capital IQ

It is noteworthy however, that this method is not foolproof. Counters that are less correlated may indicate good hedging/ diversification done by the company and can be better long term investments. Even for a short-term basis, a historically high correlation may not mean share prices would always move accordingly.

As seen in the chart below of relative percentage performance, Company A’s share price did not increase despite Company A having the highest correlation between CPO and share price of the 3.

In fact, other factors such as market sentiment on the counter, restructuring, etc may have a greater impact on the counter. Hence, a high correlation may not always be a good thing, and should definitely not be the only factor in picking palm oil counters.

Relative performance of the respective shares (%). Source: Yahoo Finance

2. Research and Development (R&D)

Certain companies have R&D arms. This is important, as certain strains of palm trees have a much greater yield. These strains are often proprietary as well.

To illustrate my point, I would use Golden-Agri Resources (GAR) as an example. GAR announced a breakthrough in research with EKA 1 and EKA 2 strains of palm seedlings. These varieties are expected to be harvested within 24 months as opposed to the average of 30 months. Furthermore, EKA 1 and EKA 2 are expected to produce 10.8 tons and 13 tons of CPO per hectare respectively. This is much higher than the current GAR average of around 8 tons of CPO per hectare.

However, it is important to note that R&D breakthroughs may not bring about rapid increases in production. This is due to two issues: production constraints for seeds, and their rate of replanting. For GAR, it is likely that large quantities of EKA 1 and EKA 2 would only materialise in 2022.

However, research and use of high yielding varieties are only one side of the coin. It is important that plasma holders cultivate the seedlings under great care to obtain their maximum potential. Hence, management and education of plasma holders is paramount (especially since some palm oil counters have a high proportion of plasma holders).

3. Biodiesel

Policies related to biodiesel are one of the most important factors influencing palm oil prices. On January 2018, the EU voted to ban biodiesel by 2020. The complete ban was then later postponed to 2030. To make up the shortfall in demand, both Indonesia and Malaysia have implemented biodiesel mandates. Indonesia seems to be more aggressive in rolling out biodiesel as compared to Malaysia. Currently, Malaysia has a B10 (10% palm methyl ester and 90% diesel) mandate with plans to implement B20 by 2020. In contrast, Indonesia already has a B20 mandate and seeks to implement B30 by next year, with the ambition to use B50 biodiesel by the end of 2020.

Those who have compared Malaysian listed counters (i.e. KLSE listed counters) with SGX listed counters (Indonesia based plantation) before would know that Malaysian counters trade at a premium compared to Indonesia based companies. It may be tempting to consider Malaysian counters as their shares command a better price even in a low CPO price environment. This also means that Malaysian palm oil counters are generally less correlated to CPO prices as compared to Indonesia based plantations.

However, in light of rising CPO prices and an aggressive Indonesia biodiesel policy, it may be worthwhile to consider Indonesia based palm oil counters on SGX as opposed to KLSE listed counters.

4. Round Table of Sustainable Palm Oil (RSPO) Certification

RSPO is a Non-Government Organisation (NGO) which seeks to unite stakeholders in the palm oil industry. It has a set of social and environmental criteria to fulfil for companies to obtain certification. RSPO certification for plantations are done every 5 years and are audited annually for compliance.

In the midst of investing, let us not forget the potential environmental impact of unsustainable palm oil plantations – especially the haze which is a problem we face from time to time. Before investing be sure to check if the company has any form of sustainable certification!

For those who are still unconvinced with investing in sustainable companies, do bear in mind dire economic consequences may result for such companies. Indofood Agri Resources were sanctioned for flouting RSPO standards and Indonesia law, and the company subsequently withdrew its RSPO membership. In response, Citibank cancelled its revolving credit facility with Indofood Agri Resources. RaboBank has also terminated its financing facility for Indofood Agri Resources and Standard Chartered has dropped the aforementioned company as a client.

Conclusion

To conclude, let us bear in mind the 4 considerations in choosing palm oil counters. Correlation to CPO prices is a simple method to use but that should not be the sole consideration. Furthermore, it would be ideal to consider the R&D pipeline of respective companies on top of comparing current yields between companies. In this current environment, Indonesian based plantations (listed on SGX) may be preferable to Malaysian listed counters. Last but not least, do check for sustainable certification!

Disclosure: Views shared on this article are for educational purposes only. Views do not indicate or insinuate any investment decisions readers should undertake and should never replace investment advice given by an investment professional. The author’s views do not represent the views of Nanyang Technological University.

References:

Citigroup, Standard Chartered, And Rabobank Cancel Substantial Loans To Palm Oil Company Indofood Over Labor Abuses. Will Others Take A Stand?: https://www.ran.org/the-understory/citi-divests-from-indofood/

EU Ban on Palm-Based Biodiesel to Negatively Impact Europe-Asia Vegoil Trade: https://www.hellenicshippingnews.com/eu-ban-on-palm-based-biodiesel-to-negatively-impact-europe-asia-vegoil-trade/

Golden-Agri Resource Subsidiary Cultivates New Palm Oil Seedlings for Better Yield: https://www.straitstimes.com/business/golden-agri-resource-subsidiary-cultivates-new-palm-oil-seedlings-for-better-yield

Indonesia’s Biodiesel Plan Fires Up ‘Red Hot’ Palm Oil Prices: https://www.ft.com/content/ead601a6-ff15-11e9-b7bc-f3fa4e77dd47

Malaysia Plan B20 Biodiesel Blending Mandate By 2020: https://biofuels-news.com/news/malaysia-plan-b20-biodiesel-blending-mandate-by-2020/

Palm Oil: Indonesia and Malaysia Push Back as EU Clamps Down: https://asia.nikkei.com/Spotlight/Asia-Insight/Palm-oil-Indonesia-and-Malaysia-push-back-as-EU-clamps-down

Palm Oil To Rise To RM2,400 A Tonne, On Higher Biodiesel Mandate: https://www.nst.com.my/business/2019/03/466178/palm-oil-rise-rm2400-tonne-higher-biodiesel-mandate

Roundtable on Sustainable Palm Oil: https://rspo.org/certification

The Chain: Mizuho and Mandiri Replace Rabobank, Citigroup and Standard Chartered for Indofood Credit Facilities: https://chainreactionresearch.com/mizuho-and-mandiri-replace-rabobank-citigroup-and-standard-chartered-for-indofood-credit-facilities/