By Ong Xien Fong

Graph of monthly CPO prices. Source: S&P Capital IQ

With rising Crude Palm Oil (CPO) prices, palm oil counters are receiving renewed interest again. Despite still being far from historic highs, some palm oil counters have dramatically increased in price recently. However, evaluating palm oil counters is not easy due to the many jargon used in reports. When I first reviewed investor presentation slides a while back, I remembered having to repeatedly Google the various jargon to try and understand the entire palm oil production process. This two part article series aims to help those interested in understanding the palm oil business so as to invest in palm oil counters. In this first part, jargon and processes would be covered to provide a foundation towards understanding the industry.

Source of CPO Prices

There are various sources of CPO prices available on the internet. This is because different exchanges may quote different prices. For this article, the author used CPO settlement prices from the Kuala Lumpur Stock Exchange (KLSE). Future CPO (FCPO) prices from the KLSE are also traded on the Chicago Mercantile Exchange (CME) Globlex. FCPO from KLSE was used due to the ready availability of prices and the close proximity to palm oil production in the region.

FCPO is a Malaysian Ringgit denominated CPO future traded on KLSE since 1980. Contracts are physically settled with a contract size of 25 metric ton of CPO. As both the Ringgit and Rupiah have depreciated against the USD over the years, it is best to caution against using CPO prices quoted in USD to filter out forex movements.

In this article, CPO prices were taken from S&P Capital IQ, a paid platform. CPO prices can also be monitored for free from the Malaysian Palm Oil Council (MPOC) page or from Business Insider.

A simplified flowchart of the processes in the palm oil industry.

The above is a simplified flowchart on the entire process of palm oil and its products. Some parts of this process will be further explained later.

Comparison of Profit Margin Across Segments

Palm oil companies often report revenue from two segments:

1. Plantation/ Mills

2. Refinery/ Palm Laurics and Others

In order to decrease dependency on palm oil prices, there has been an increasing trend towards increasing revenue from downstream operations (Refinery). This trend gives the impression that downstream operations may be more profitable even though that may not be the case.

According to a business analyst from Toptal, upstream business (Plantation/ Mills) is actually the most lucrative (accounting for 50-60% profit of the value chain) followed by downstream oleochemical processing (15-25% profit of the value chain). The author has found this to be consistent with two large palm oil companies listed on SGX as well.

Graph of EBITDA margin across segments. Source: Bloomberg

As seen in the graph above, both Golden Agri-Resources and First Resources have much higher margins for the upstream business (plantations and palm oil mills) than their downstream business. For Golden Agri-Resources, ‘Palm, Laurics, Oilseeds & Others’ in their reports refer to “processing and merchandising of palm and oilseed-based products” and “production and distribution of other consumer products” (their downstream business).

Given that the upstream plantation business is the most lucrative, we would now delve into deeper insights into the jargon and processes.

Understanding Significant Jargon and Processes

Screenshot of investor presentation slides from First Resources.

The above image is part of an investor presentation slide. Such jargon are not uncommon and are important in making an investment decision in palm oil companies. The following part of the article will explain all the above jargon. If the below is too technical, fret not! These jargon are summarised in the second last paragraph.

1. Milling

After planting and harvesting, milling is the next process that is undertaken for the creation of palm oil (see flowchart). Milling is often done in close proximity to the plantation as Fresh Fruit Bunches (FFB) must be processed within 24 hours to prevent degradation of the oil. Steam is used to sterilise the fruits, soften the flesh and deactivate enzymes which would degrade the oil. The loose fruits are then crushed to produce oil (later further processed to become CPO), nuts and Palm Kernel Meal (PKM). The nuts are then used to produce Palm Kernel Oil (CKO). PKM is protein and fibre rich and is often used as animal feed, fertiliser or fuel for the milling process.

2. Crude Palm Oil vs Palm Kernel Oil

Crude Palm Oil (CPO) is oil derived from the flesh of the fruit while Crude Kernel Oil (CKO) is derived from the oil of the nut. Unrefined CPO is liquid at room temperature and is red. The end product (refined) CPO is the cooking oil we commonly use. On the other hand, PKO is solid at room temperature due to its high content of saturated fats.

CPO is the predominant product; for every 10 parts of CPO produced, 1 part of CKO is produced. Hence, CPO prices are often used as a leading indicator on how palm oil companies will perform.

3. Nucleus vs Plasma

Plasma holders are small independent farmers who agree to sell their fruits to a larger company. In exchange, these farmers enjoy benefits such as advice on plantation techniques, micro-financing (important for replanting efforts) and higher yielding strains of palm trees. In contrast, Nucleus plantations are maintained and held by the company itself.

Apart from the symbiotic relationship between plasma holders and palm companies it is noteworthy that companies have a plasma obligation under Indonesian law. Under Permentan No. 26/2007, plantations license (Izin Usaha Perkebunan (IUP)) for over 250 hectares issued after 2007 must provide 20% of land to local communities to be plasma holders. Companies with IUPs before 2007, though not obligated, must show evidence of improving local community lives.

4. Age of Plantations

Palm oil companies often provide a breakdown of the age of their plantations. But how much does production change for each phase of the life of a palm tree?

Commercial harvesting starts out at 3 years and production starts to rapidly increase thereafter. The optimal is then achieved from 8-18 years followed by a gradual decline in production. The commercial timespan of palm trees is about 25 years. Plantation with older trees face a double whammy; lower production yields and higher cost of harvesting.

The million dollar question currently is the optimal age for replanting. Unfortunately, there is no easy answer to that as there are numerous factors. At the basic beyond the optimal yield, the primary consideration is the expected future prices of palm oil and how long the high prices will last. High prices that are expected to last long will result in shorter optimal replanting as profit from future palm trees will be more than if no replanting was done. If high prices are not expected to last long, replanting should be postponed to maximise profit. Furthermore, replanting is not cheap due to the cost of planting, financing issues and lost in income.

If the 4 jargon are still too hard to comprehend, in essence, milling is the first step of processing. CPO, the predominant product, is the cooking oil we use while CKO is oil solid at room temperature. Nucleus is plantation owned by the company while plasma is owned by smallholders who agree to sell to a certain company in exchange for financial or other forms of assistance. The optimal age of fruit production for palm trees is between 8-18 years.

To conclude, this article covered the significant processes of palm oil production. Common jargon in investment materials such as CPO and CKO were also covered. In the next part of this article, you will learn other important considerations for selecting palm oil counters. Look out for the next part to find out more!

After explaining the significant processes of palm oil production, this article will cover four other important points to consider when picking palm oil counters.

1. Correlation to Crude Palm Oil (CPO) Prices

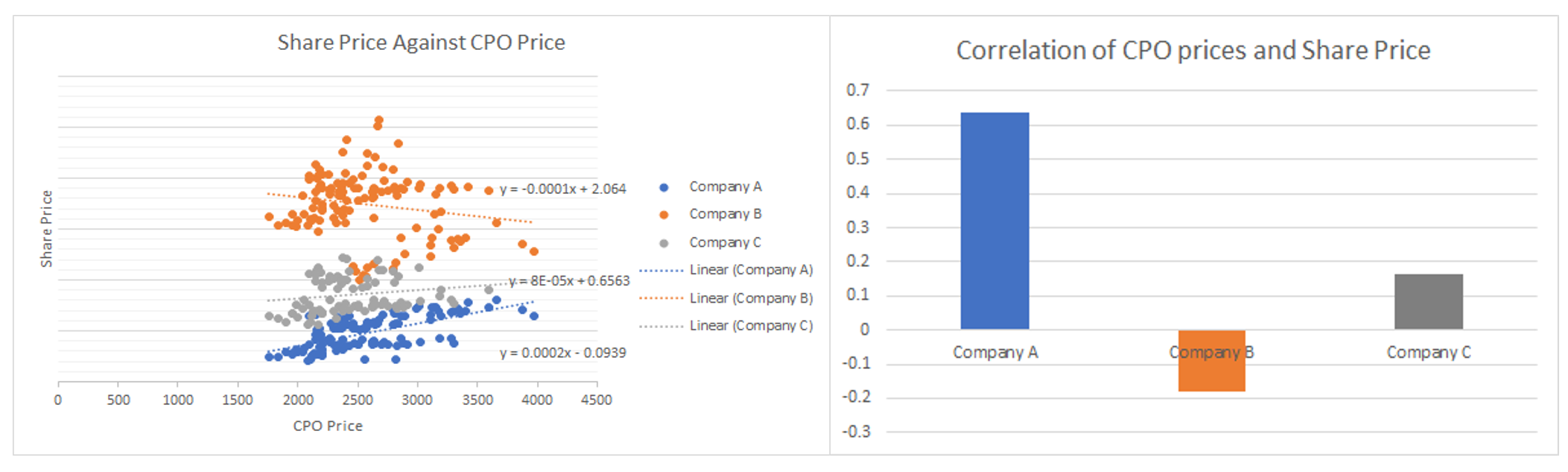

Some investors use the correlation of share price to CPO prices to determine which counters to buy. The logic from this method stems from the fact that CPO is the predominant product of palm oil producers and the increase in prices of CPO would result in an increase in the share price of the palm oil counters as well. The variation in correlation of different palm oil counters can be vast. This can be seen from the correlation bar chart (below) of 3 different SGX counters and CPO prices.

To those who are less familiar with this comparison, correlation can be calculated using Excel by using CPO prices and share prices as the two arrays of data. CPO prices can be obtained as mentioned in part I of this article while historical share prices can be downloaded from Yahoo finance. Correlation ranges from +1 to -1 with +1 being perfectly correlated, -1 being perfectly negatively correlated and 0 being uncorrelated.

Graph of Share Price against CPO Price and Linear Regression. Bar Chart of Correlation of CPO Prices and Share Price. Prices are over a 10 year horizon except for 1 company (due to the date of listing). Source: Yahoo Finance, S&P Capital IQ

It is noteworthy however, that this method is not foolproof. Counters that are less correlated may indicate good hedging/ diversification done by the company and can be better long term investments. Even for a short-term basis, a historically high correlation may not mean share prices would always move accordingly.

As seen in the chart below of relative percentage performance, Company A’s share price did not increase despite Company A having the highest correlation between CPO and share price of the 3.

In fact, other factors such as market sentiment on the counter, restructuring, etc may have a greater impact on the counter. Hence, a high correlation may not always be a good thing, and should definitely not be the only factor in picking palm oil counters.

Relative performance of the respective shares (%). Source: Yahoo Finance

2. Research and Development (R&D)

Certain companies have R&D arms. This is important, as certain strains of palm trees have a much greater yield. These strains are often proprietary as well.

To illustrate my point, I would use Golden-Agri Resources (GAR) as an example. GAR announced a breakthrough in research with EKA 1 and EKA 2 strains of palm seedlings. These varieties are expected to be harvested within 24 months as opposed to the average of 30 months. Furthermore, EKA 1 and EKA 2 are expected to produce 10.8 tons and 13 tons of CPO per hectare respectively. This is much higher than the current GAR average of around 8 tons of CPO per hectare.

However, it is important to note that R&D breakthroughs may not bring about rapid increases in production. This is due to two issues: production constraints for seeds, and their rate of replanting. For GAR, it is likely that large quantities of EKA 1 and EKA 2 would only materialise in 2022.

However, research and use of high yielding varieties are only one side of the coin. It is important that plasma holders cultivate the seedlings under great care to obtain their maximum potential. Hence, management and education of plasma holders is paramount (especially since some palm oil counters have a high proportion of plasma holders).

3. Biodiesel

Policies related to biodiesel are one of the most important factors influencing palm oil prices. On January 2018, the EU voted to ban biodiesel by 2020. The complete ban was then later postponed to 2030. To make up the shortfall in demand, both Indonesia and Malaysia have implemented biodiesel mandates. Indonesia seems to be more aggressive in rolling out biodiesel as compared to Malaysia. Currently, Malaysia has a B10 (10% palm methyl ester and 90% diesel) mandate with plans to implement B20 by 2020. In contrast, Indonesia already has a B20 mandate and seeks to implement B30 by next year, with the ambition to use B50 biodiesel by the end of 2020.

Those who have compared Malaysian listed counters (i.e. KLSE listed counters) with SGX listed counters (Indonesia based plantation) before would know that Malaysian counters trade at a premium compared to Indonesia based companies. It may be tempting to consider Malaysian counters as their shares command a better price even in a low CPO price environment. This also means that Malaysian palm oil counters are generally less correlated to CPO prices as compared to Indonesia based plantations.

However, in light of rising CPO prices and an aggressive Indonesia biodiesel policy, it may be worthwhile to consider Indonesia based palm oil counters on SGX as opposed to KLSE listed counters.

4. Round Table of Sustainable Palm Oil (RSPO) Certification

RSPO is a Non-Government Organisation (NGO) which seeks to unite stakeholders in the palm oil industry. It has a set of social and environmental criteria to fulfil for companies to obtain certification. RSPO certification for plantations are done every 5 years and are audited annually for compliance.

In the midst of investing, let us not forget the potential environmental impact of unsustainable palm oil plantations – especially the haze which is a problem we face from time to time. Before investing be sure to check if the company has any form of sustainable certification!

For those who are still unconvinced with investing in sustainable companies, do bear in mind dire economic consequences may result for such companies. Indofood Agri Resources were sanctioned for flouting RSPO standards and Indonesia law, and the company subsequently withdrew its RSPO membership. In response, Citibank cancelled its revolving credit facility with Indofood Agri Resources. RaboBank has also terminated its financing facility for Indofood Agri Resources and Standard Chartered has dropped the aforementioned company as a client.

Conclusion

To conclude, let us bear in mind the 4 considerations in choosing palm oil counters. Correlation to CPO prices is a simple method to use but that should not be the sole consideration. Furthermore, it would be ideal to consider the R&D pipeline of respective companies on top of comparing current yields between companies. In this current environment, Indonesian based plantations (listed on SGX) may be preferable to Malaysian listed counters. Last but not least, do check for sustainable certification!

Disclosure: Links from the website are not related to NTU-IIC nor the author. The author merely seeks to advise the readers on where to derive data and is not paid by the above links and would not be responsible for any loss, damages or pricing inaccuracies from the above links. Views shared on this article are for educational purposes only. Views do not indicate or insinuate any investment decisions readers should undertake and should never replace investment advice given by an investment professional. The author’s views do not represent the views of Nanyang Technological University.

References:

Alam, A S A Ferdous & Er, Ah Choy & Begum, Halima. (2015). Malaysian oil palm industry: Prospect and problem. Journal of Food, Agriculture and Environment. 1313. 143-148.

An Investor’s Guide to Palm Oil: https://www.toptal.com/finance/market-research-analysts/palm-oil-investing

Citigroup, Standard Chartered, And Rabobank Cancel Substantial Loans To Palm Oil Company Indofood Over Labor Abuses. Will Others Take A Stand?: https://www.ran.org/the-understory/citi-divests-from-indofood/

Crude Palm Oil Mill Process: https://andythoncianus.wixsite.com/andythoncianus/single-post/2018/03/11/Crude-Palm-Oil-Mill-Process

EU Ban on Palm-Based Biodiesel to Negatively Impact Europe-Asia Vegoil Trade: https://www.hellenicshippingnews.com/eu-ban-on-palm-based-biodiesel-to-negatively-impact-europe-asia-vegoil-trade/

FCPO Product Brochure: https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/assets/5d5e64575b711a6fbc2aa31f/FCPO_Product_Brochure_200219.pdf

Golden-Agri Resource Subsidiary Cultivates New Palm Oil Seedlings for Better Yield: https://www.straitstimes.com/business/golden-agri-resource-subsidiary-cultivates-new-palm-oil-seedlings-for-better-yield

Indonesia: “Plasma Obligation” For Oil Palm Plantation Business Established Prior To The Issuance Of Regulation Of The Indonesian Minister Of Agriculture No.26/2007: http://www.mondaq.com/x/467128/Inward+Foreign+Investment/Plasma+Obligation+For+Oil+Palm+Plantation+Business+Established+Prior+To+The+Issuance+Of+Regulation+Of+The+Indonesian+Minister+Of+Agriculture+No262007

Indonesia’s Biodiesel Plan Fires Up ‘Red Hot’ Palm Oil Prices: https://www.ft.com/content/ead601a6-ff15-11e9-b7bc-f3fa4e77dd47

Malaysia Plan B20 Biodiesel Blending Mandate By 2020: https://biofuels-news.com/news/malaysia-plan-b20-biodiesel-blending-mandate-by-2020/

Palm Oil: Indonesia and Malaysia Push Back as EU Clamps Down: https://asia.nikkei.com/Spotlight/Asia-Insight/Palm-oil-Indonesia-and-Malaysia-push-back-as-EU-clamps-down

Palm Oil To Rise To RM2,400 A Tonne, On Higher Biodiesel Mandate: https://www.nst.com.my/business/2019/03/466178/palm-oil-rise-rm2400-tonne-higher-biodiesel-mandate

Plasma Scheme: https://www.bumitama-agri.com/page/layout/24/23/plasma-scheme

Riverina: https://www.riverina.com.au/products/palm-kernel-meal/

Roundtable on Sustainable Palm Oil: https://rspo.org/certification

The Chain: Mizuho and Mandiri Replace Rabobank, Citigroup and Standard Chartered for Indofood Credit Facilities: https://chainreactionresearch.com/mizuho-and-mandiri-replace-rabobank-citigroup-and-standard-chartered-for-indofood-credit-facilities/

The Optimal Age of Oil Palm Replanting: http://palmoilis.mpob.gov.my/publications/OPIEJ/opiejv2n1-2.pdf