By Muskaan Ahuju

Morningstar defines large-cap companies as those that account for the top 70% of the capitalisation of a domestic stock market. Mid-cap stocks represent the next 20% and small-cap stocks make up the remainder. Companies are classified as large-, mid- or small-cap based on their market capitalisation, which is calculated by multiplying the share price by the number of shares outstanding. Simply put, market capitalisation represents a company’s dollar market value.

In Singapore, the FTSE ST Large & Mid Cap index comprises of large and mid-cap stocks, and it makes up about 86% of the Singapore market capitalisation. Companies on the STI are also included in this index. Well-known names like DBS Grp, Singtel, OCBC Bank, CapitaLand Ltd., etc make up the list of large-cap stocks. These tend to be large, established organisations, and their market capitalisation is generally above $10 billion.

Meanwhile, mid-cap stocks represent a market capitalisation between $1 billion to $10 billion. Apart from the FTSE Large & Mid Cap Index, the FTSE ST Mid Cap Index also comprises of mid-cap shares. It is a market capitalisation weighted index that tracks the performance of the next top 50 Companies (after the STI constituents) listed on SGX. Some examples of Singapore mid-cap stocks are SBS Transit, United Engineers, Yanlord Land Group, Sheng Siong Group, etc.

Lastly, the FTSE ST Small Cap Index tracks the performance of companies listed on SGX that are within the top 98% (by market capitalisation), except for those included in the STI and FTSE ST Mid Cap Index. These have a market cap of less than $1 billion. Some examples are Breadtalk, Federal International, etc.

Given the information about classification of shares by market cap, an investor is faced with the dilemma of investing in the share-type best suited for his needs, as different share types offer vastly different risk-return profiles. In times of economic instability and market upheaval, a company is bound to have periods where the stock loses value. In such a scenario, looking at the overall stability of a company’s stock is important. A great deal of fluctuation, more often than not, is a red flag. If, however, the loss in stock value is a result of worsening market conditions, you may want to consider the stock.

In a market ripe with an abundance of stocks to invest in, it is important to hand pick those that best suit your needs as an investor. The first step to doing so is learning about the pros and cons of each type of share, and some considerations have been listed out below.

1. Growth Prospects

Small-cap stocks are attractive for their growth prospects. However, their growth may be outshined by mid-caps as they generally feature strong management and seasoned business practices, and hence their growth comes with less volatility and faster rates with this added advantage of financial stability. In contrast, large-cap stocks may have relatively limited growth potential as it is in general harder to improve and grow a well established company than a smaller one.

To gauge the sustainability of growth, indicators such as free cash flow, earnings growth, debt-to-equity ratio and price-to-earnings ratio can be used. In 2019, the STI had a 5% YoY growth, which was lower compared to the FTSE ST Mid Cap Index and FTSE ST Small Cap Index with 11% and 8% YoY growth respectively.

However, it is important to note that higher risk does not always equate to higher returns. This is reflected in the under performance of the FTSE ST Catalist Index, which consists of fast-growing companies listed on the Singapore Exchange’s (SGX) junior board and had a YoY growth rate of -12%.

2. Risk

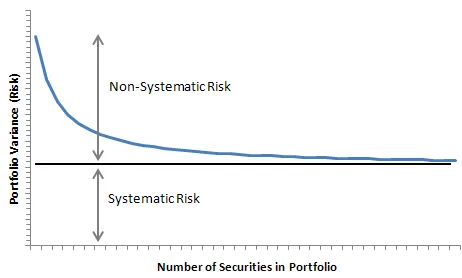

Amongst the three types of shares, large-cap shares are the least risky due to their strong financial health and strong state of operations. Mid-cap companies pose some risk as there is always a chance of a merger or acquisition with bigger companies. Furthermore, investing in mid-caps requires an investor to analyse the sustainability of growth prospects. Small-cap stocks are the most risky, as they are the first to falter in times of economic downturns and come with significant levels of volatility.

3. Availability of information

Large and mid-cap stocks are analysed by a plethora of analysts, making research and information abundantly available for investors. This can assist an investor in making a well-informed decision. However, it also means that it is harder to find a mispriced stock and buy it at a discount. Large and mid-cap stocks are almost always fairly priced. On the contrary, small-cap companies are less known, and it is possible for an investor to find a mispriced security.

4. Dividends

Large-cap companies, at large, are better equipped to pay out dividends due to the strong economies of scale facilitated by widespread operations. This is also an indicator of stability. Dividend payouts are an attractive feature to many investors. However, one should be wary of disproportionately high dividends as this means a company is not reinvesting to improve its operations. While many small and mid-cap companies don’t pay dividends, or only pay a minimal amount due to their need to reinvest, they still remain an attractive option in terms of growth potential

Overall, these factors are some very basic considerations that can aid an investor in making a well-informed decision! An investor should consider his time horizon and risk appetite while choosing stocks. Furthermore, it is ideal to choose stocks of varying market capitalisations that can help further diversify the portfolio and mitigate risks.

References

https://www.moneyobserver.com/opinion/why-small-caps-should-be-big-consideration

https://www.morningstar.co.uk/uk/news/105769/investing-in-small-mid-and-large-cap-stocks.aspx

https://www.tradingview.com/markets/stocks-singapore/market-movers-large-cap/

http://news.morningstar.com/pdfs/FactSheet_StyleBox_Final.pdf

https://www.ftserussell.com/products/indices/sgx-st

https://www2.sgx.com/indices/products/ftfstlm

https://www.straitstimes.com/business/companies-markets/catalist-index-to-include-14-more-stocks